“Crypto Countries: The Rise of CBDCs and How They’re Transforming the Global Financial Landscape” by Mark M. Whelan

Central bank digital currencies (CBDCs) are digital versions of a country’s fiat currency, issued and backed by the country’s central bank. These digital currencies can be used in the same way as physical cash, but they also have the potential to offer additional features, such as increased security and faster transaction processing times.

The main advantage of CBDCs is that they can make the financial system more efficient and inclusive. For example, they can help to reduce the cost of financial transactions, making it easier for people to access financial services, and they can also provide a more secure and stable form of money, particularly in times of economic crisis.

However, there are also some potential drawbacks to the use of CBDCs. One concern is that they could potentially displace physical cash, which could be problematic for people who are unable to access digital financial services, such as the elderly or those living in remote areas. Another concern is that the use of CBDCs could give the central bank too much control over the money supply, which could lead to inflation or other economic problems. Additionally, there are also concerns about the security and privacy of CBDCs, as they could be vulnerable to cyberattacks or other forms of digital fraud.It is important to research digital assets before investing in them because, like any investment, there is a risk of loss. By researching a digital asset, you can better understand # its potential value and risks. This can help you make more informed investment decisions and avoid scams or other pitfalls. Additionally, researching a digital asset can help you understand how it works and how it fits into the broader market for digital assets, which can also help you make more informed investment decisions. That’s why I recommend www.coingryphon.com.

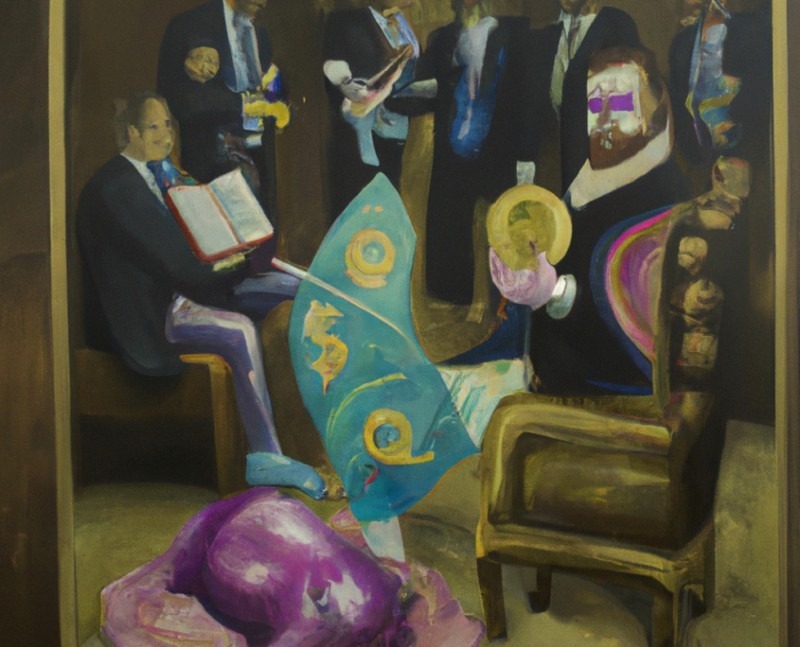

To learn more about emerging trends by Mark M. Whelan or his artwork.

Visit Future Center Ventures

Or my new book available on Amazon and Apple.

Originally published at https://www.markmwhelan.com on December 6, 2022.