Human IPO

Human IPO, also known as a personal IPO, refers to the idea of selling shares in a person’s future earnings or abilities. This concept is based on the idea that a person’s future income and potential can be viewed as a financial asset that can be bought and sold like any other security.

The importance of a human IPO lies in its potential to provide a new source of funding for individuals, especially those who may not have access to traditional forms of financing such as loans or credit. By selling shares in their future earnings or abilities, individuals could potentially raise capital to invest in their education, career, or business ventures.

However, there are also potential pitfalls associated with a human IPO. One of the main challenges is the issue of fairness and equity. If a human IPO were to become widespread, it could create a two-tier system in which some individuals have access to large amounts of capital, while others do not. This could exacerbate existing inequalities and create new barriers to opportunity.

Another potential pitfall is the issue of risk and uncertainty. The future earnings and abilities of individuals are difficult to predict, and there is a high degree of uncertainty associated with investing in a human IPO. This could lead to a high level of risk for investors, and could potentially result in financial losses.

In summary, a human IPO has the potential to provide a new source of funding for individuals. However, the potential for unfairness and the high level of risk and uncertainty associated with this concept raise significant concerns that need to be carefully considered.Try again

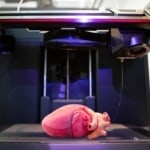

That’s the premise of the company Human IPO, which sells shares of people with promise on an open market that can be redeemed in five years for one hour of the person’s time per share.

NBA point guard Spencer Dinwiddie also put his future success on the market by offering fans Dream Fan Shares, which allowed him to collect $13.5 million upfront in advance of his $34 million three-year contract, with shares delivering fans 4.95% monthly interest and full payment of principal upon maturity.

Lambda School is betting on the future potential of its students by offering students deferred tuition that only kicks in on a sliding scale based upon getting hired and the amount of salary earned.